Labour market stabilises at a high level: skilled catering and sales personnel currently have the best job prospects

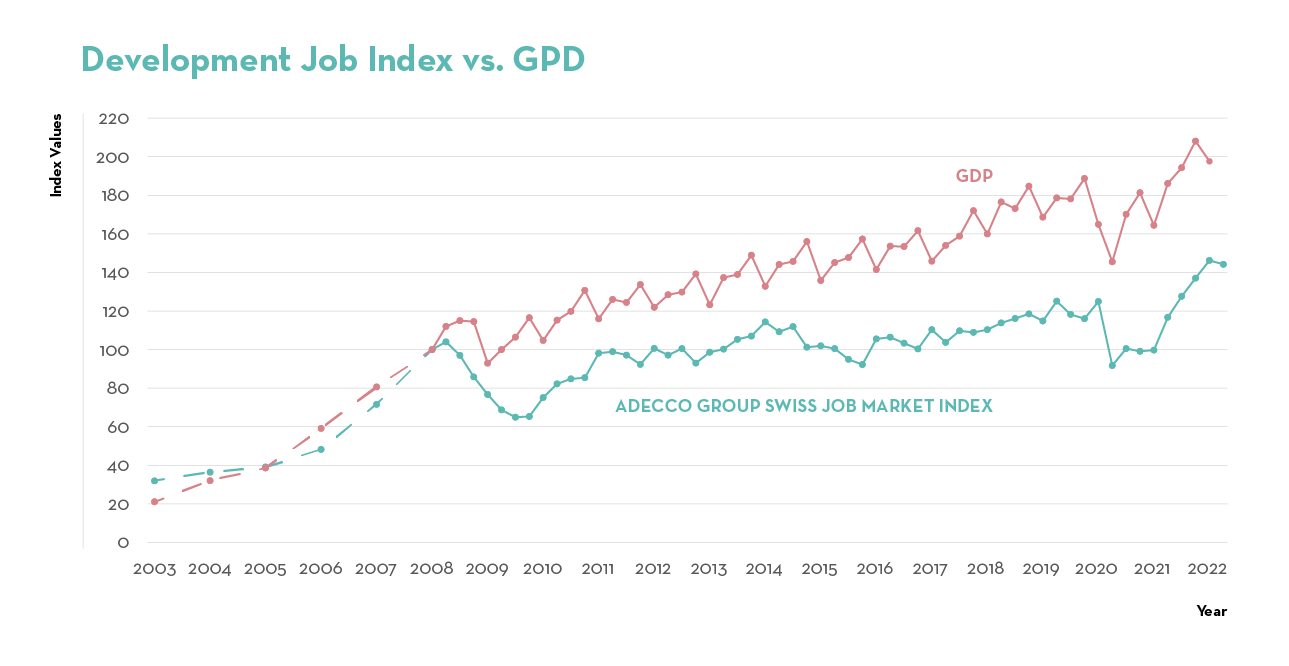

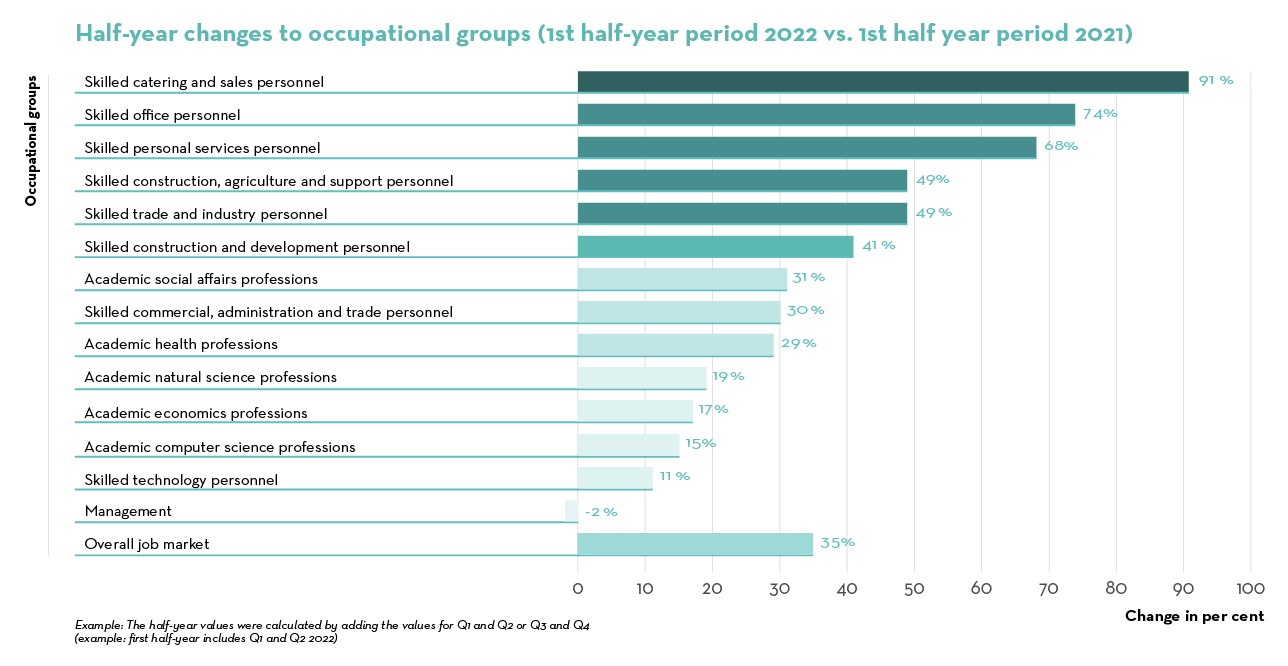

Zurich, 5 July 2022 – The Swiss labour market broke records for the past three quarters in a row, but this trend has come to a temporary halt as global uncertainties have continued to rise in the first six months of 2022. However, the majority of occupational groups are benefiting from the post-pandemic economic recovery, as shown by a clear increase in job advertisements. Skilled personnel in catering and sales are at the forefront of this trend, with management the only occupational group that has not seen much change compared to the first six months of 2021. These are the findings of the Adecco Group Swiss Job Market Index, a scientifically substantiated survey developed by the University of Zurich’s Swiss Job Market Monitor.

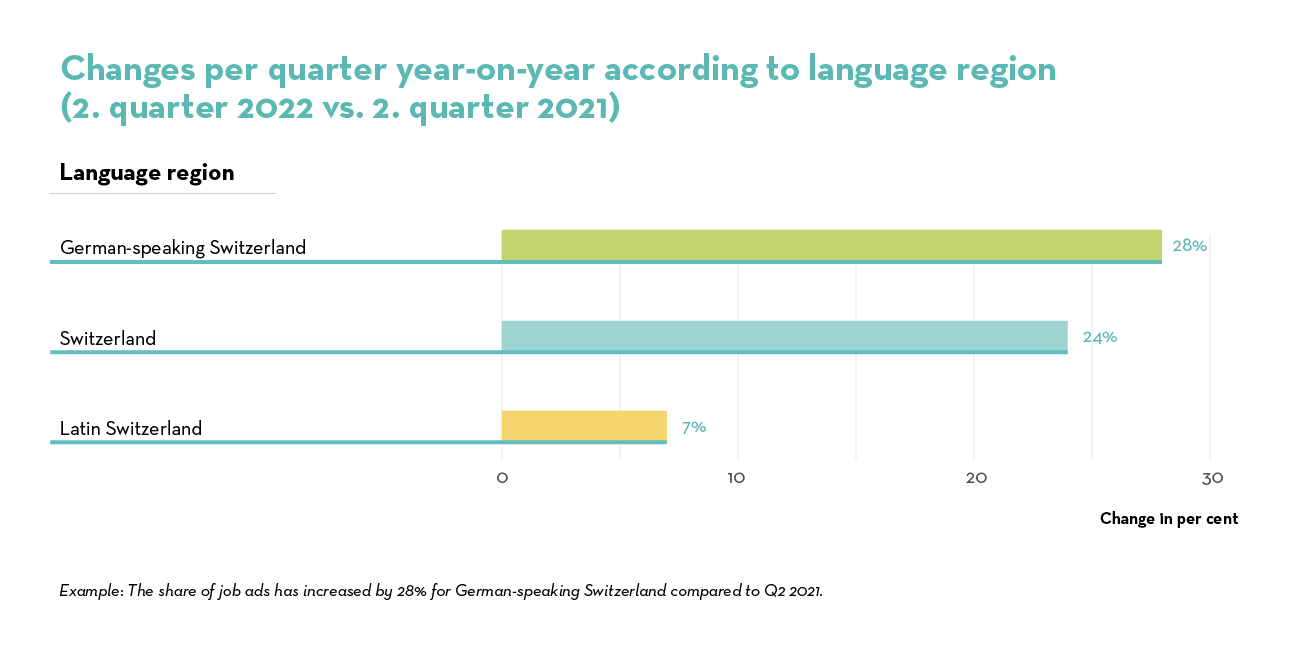

The Swiss job market has only been heading in one direction since Q1 2021 – and that is skyward. The Job Index has recorded several records in quick succession, but job market growth is currently experiencing a substantial slowdown. It now remains at a historic high. The index has seen a slight drop of 0.7% on the previous quarter (Q1 2022), while there are 24% more jobs advertised than in the same quarter in the previous year (Q2 2021).

The slump on the labour market seems to be caused by the changed economic climate. While Swiss companies took an overwhelmingly positive view of macroeconomic trends at the start of the year, this euphoria has become rather more muted in recent months. One only need look at the economic climate and the KOF Economic Barometer to see that stakeholders in Switzerland’s economy will soon be faced with a slowdown of economic growth. As a result, the Swiss Employers Confederation is forecasting aneconomic slowdown, warning that some companies have already started turning down orders that would require them to take on extra staff. . In addition, the conflict in Ukraine is leading to heightened geopolitical risks and limiting investment.

"The economic environment has become more uncertain for Swiss companies. Ongoing supply-chain issues and increasing energy prices are raising the cost of manufacturing and shrinking profit margins. Given the global economic slowdown, it can be assumed that international demand for Swiss-made goods could fall in the short to medium term. All these factors could lead to companies being more cautious with their HR planning than a few months ago."

Marcel Keller, Country Head at Adecco Switzerland

Clear improvement across all language regions

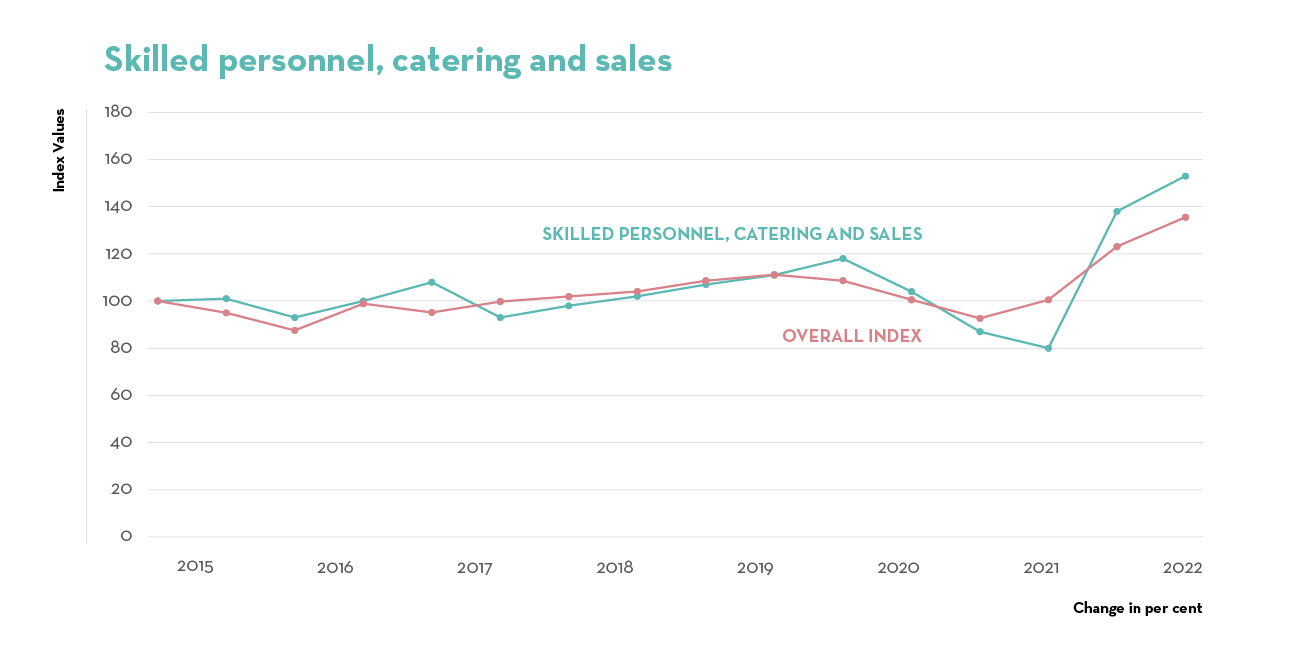

Skilled catering and sales personnel in more demand than ever (+91%)

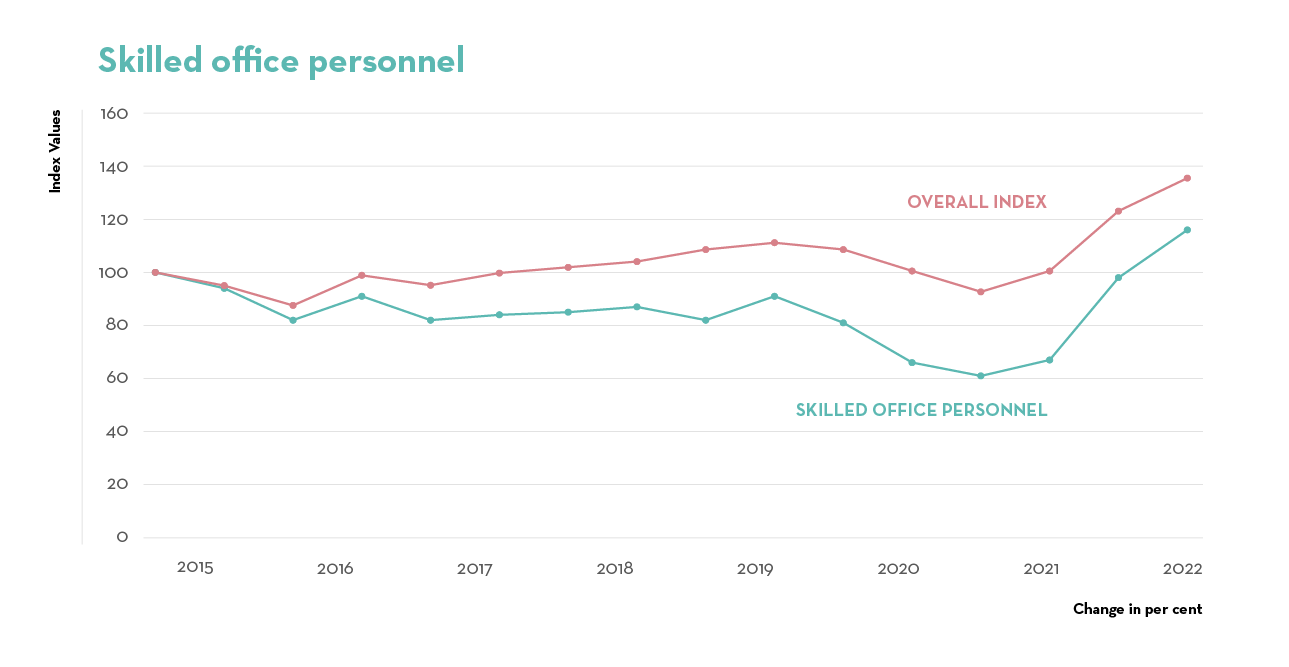

Strong job growth for skilled office personnel (+74%)

Skilled office personnel, such as travel agents, general office staff and customer service operatives, were struck a similar blow by the coronavirus crisis. As a result, the jobs advertised for skilled office personnel hit a record low in the second half of 2020. This sharp drop in 2020 might be surprising at first glance, given that measures like working from home and social distancing are relatively easy to implement for these occupations in many instances. However, many companies introduced a hiring freeze in this period, with skilled office personnel affected by this. Besides this, many jobs are advertised for these specialists in sectors that had their activities heavily curtailed by coronavirus-related measures (e.g. the tourism industry).

The recovery phase started as early as the first six months of 2021. Since this point, the number of job advertisements posted for this occupational group has continued to increase, with skilled office personnel seeing an increase of 74% in the current six-month period compared to the same six-month period last year. In addition, the index value for this occupational group has hit a record figure of 28% above pre-pandemic levels. All told, skilled office personnel currently have more jobs open to them than ever before.

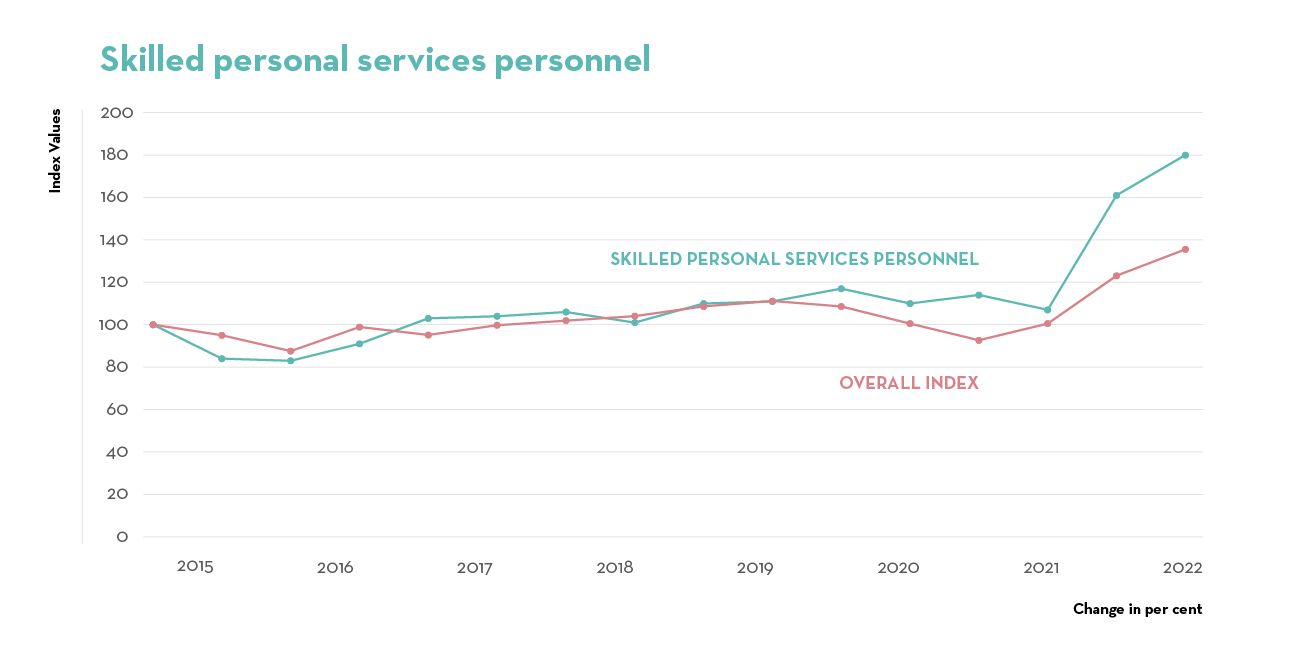

Skilled personal services personnel (+68%)

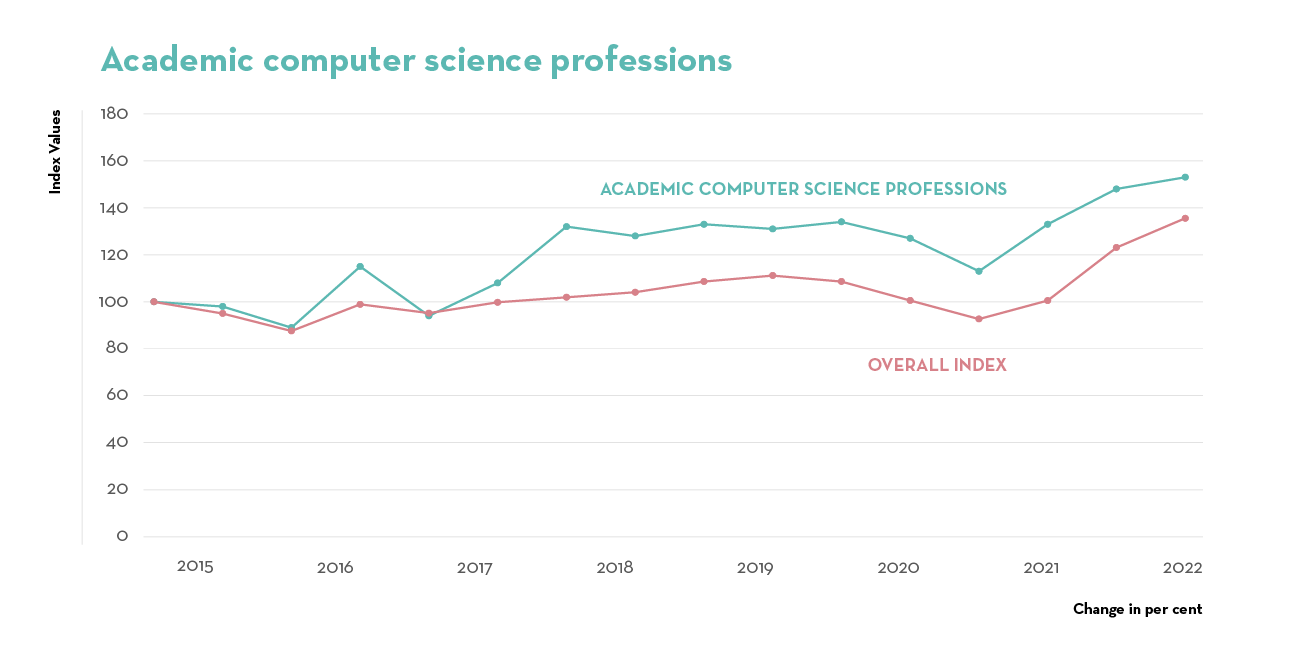

Slower growth for academic computer science professions (+15%)

Academic computer science professions, including occupations such as software developers and database specialists, reached their nadir during the pandemic in the second half of 2020. At this point, the number of job advertisements in this field was 16% down on the same period in the previous year (second half of 2019). This occupational group was able to enjoy a comparatively swift recovery from here on, already reaching pre-Covid levels by the next six-month period (first six months of 2021). Job growth has, however, slowed down somewhat since the second half of 2021, which explains its rather lower increase (15%) on the first six months of 2021. Nevertheless, this occupational group has also reached a record peak of 17% above pre-pandemic levels for the first six months of 2022.

"Academic computer science professions were primarily able to benefit from the fact that digitalisation was ascribed a higher economic priority by the pandemic. In 2021, companies increased their investments in digitalisation projects ,with the aim of speeding up their transformation processes. These investments led to rapid growth in demand for suitable IT specialists.’"

Yanik Kipfer, Swiss Job Market Monitor

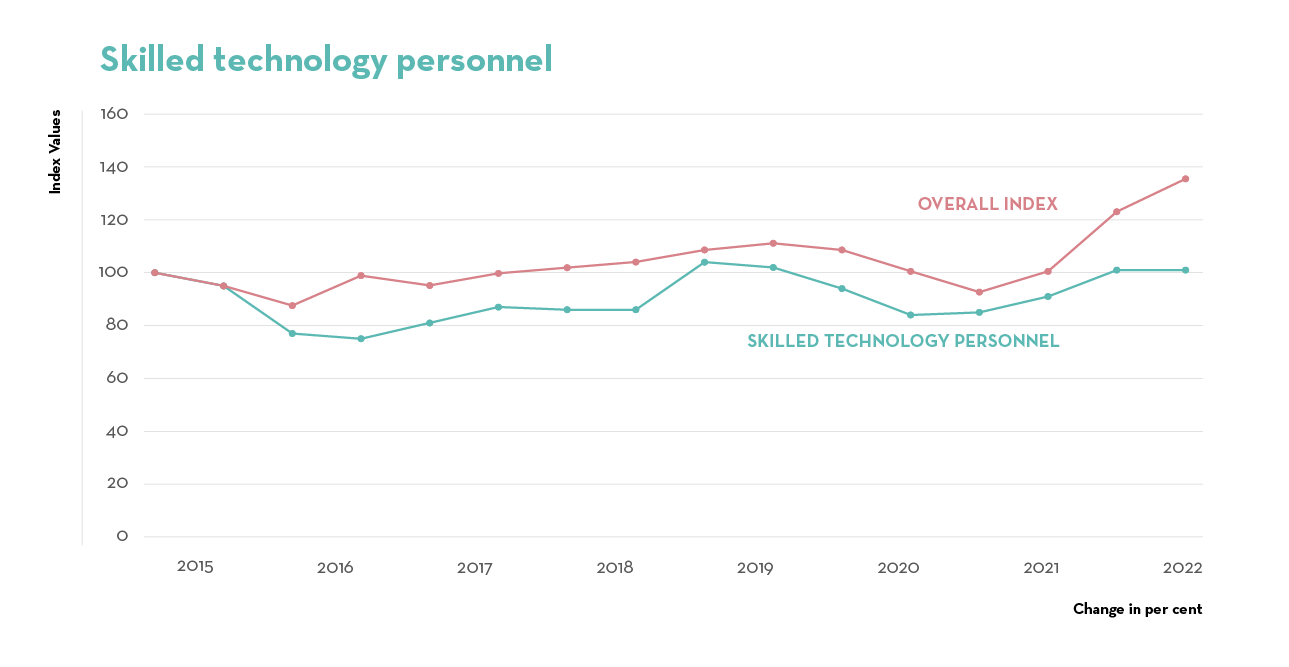

Demand for skilled technology personnel stabilises at pre-pandemic level (+11%)

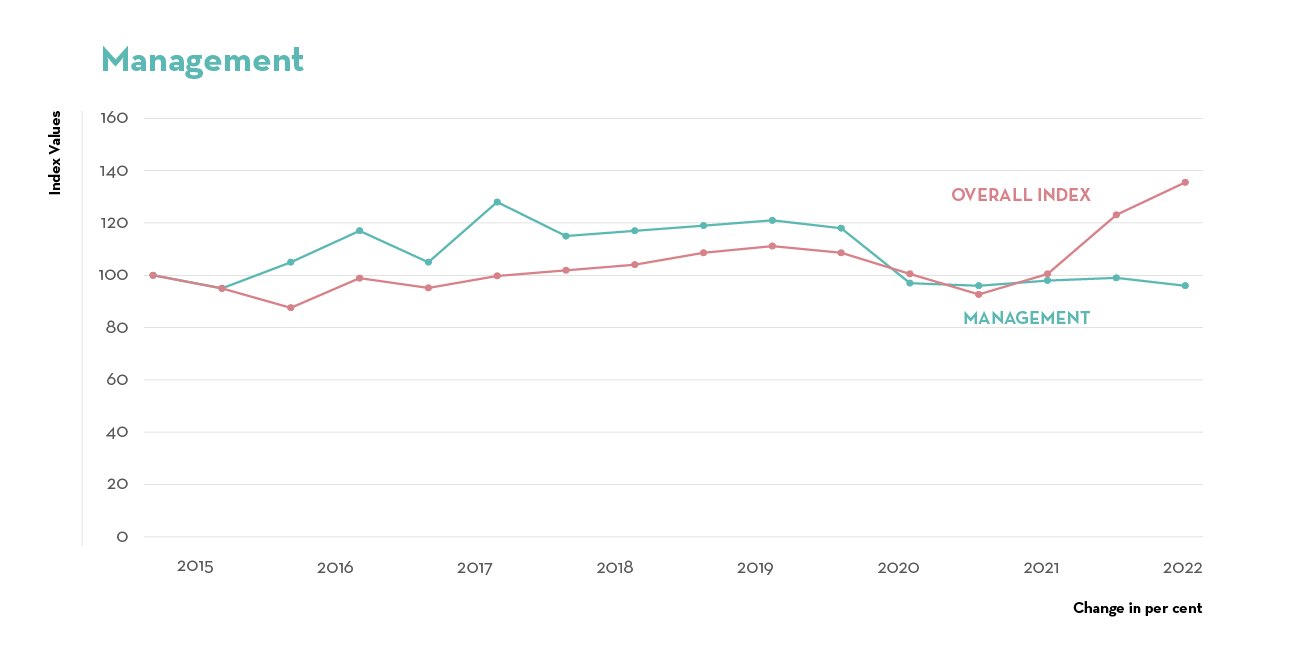

Persistently low demand for managers after the outbreak of coronavirus (-2%)

Management is the only occupational group that has not seen much change compared to the first six months of 2021. In the first half of 2020, the number of job advertisements posted for management dropped by 20% compared to the same six months in the year before the pandemic (first six months of 2019). The index value for management has remained at a comparatively low level since then.

"Unlike the other occupational groups, we have not seen increased demand for management since the pandemic broke out. The post-pandemic recovery has led to international and domestic demand alike increasing over a very short period of time within the past year. At present, many companies remain faced with the challenge of swiftly servicing high levels of demand, and they primarily need to focus on expanding their workforce to achieve this. If companies don’t have the necessary skilled workers, like chefs, tradespeople and office staff, they cannot maintain their operational activities. As a result, their search for management is taking a back seat."

Marcel Keller, Country Head at Adecco Switzerland "

Side note: the proportion of employees in each occupational group

Distribution of employees by occupational group (as at 2020)

Occupational group | Total (in 1000) | Percentage |

12% | Skilled construction, agriculture and support personnel | 520 |

12% | Skilled office personnel | 506 |

11% | Academic social affairs professions | 476 |

11% | Management | 450 |

10% | Skilled personal services personnel | 421 |

7% | Skilled commercial, administration and trade personnel | 276 |

7% | Skilled catering and sales personnel | 297 |

5% | Academic health professions | 207 |

5% | Skilled technology personnel | 208 |

5% | Skilled trade and industry personnel | 205 |

5% | Skilled construction and development personnel | 222 |

4% | Academic economics professions | 167 |

3% | Academic natural science professions | 131 |

3% | Academic computer science professions | 140 |