This article is authored by Bill FitzPatrick, Group Senior Vice President, and Global Industry Lead for Supply Chain & Logistics

From the global pandemic to inflation to macroeconomic conditions to the war in Ukraine, unprecedented, unpredictable crises can significantly impact your company’s supply chain.

Although companies aren’t able to foresee what will occur or when they can mitigate risks, they can take these five steps to lessen the impact a supply chain crisis might have on their organization.

5 Ways to Prepare Your Supply Chain for a Crisis

1. Rely on data

The best way for organizations to prepare for a crisis is through the use of data to make decisions, both strategically and tactically.

There’s a wealth of data to tap into, both internally and externally—it’s about how you effectively use it. That seems to be the largest challenge that a lot of organizations must overcome to prepare for the next crisis.

Once you gather data, organize and structure it in a format that makes sense so you’re asking the right questions and looking at time horizons of data. How relevant is the data—is it pre- or post-COVID-19? Is it based on demographics that you're trying to attract and retain?

Review data for a particular market to pull in external data and then manipulate it to view it on a broader scale and look for patterns in hiring or retaining talent. Are the wage rates in line with attracting and retaining talent? That’s a key metric.

Another one is resignations. What were the main reasons people left? Was it work or flexibility? Was it the hourly wage rate? Was it the environment or culture? Was it enough to keep people motivated to come to work every day? Supply chain jobs are physically demanding jobs in that you have to come to a specific location to execute those jobs.

2. Strategize a Plan A, B, and C

There’s always a plan A, B, and C. Think about the current state—where are you today? How do you de-risk this as much as possible? If one situation occurs, how do you move and pivot to another one? For example in the U.S., if you’re getting your inventory from the west coast, how do you shift to the east coast with minimal risk?

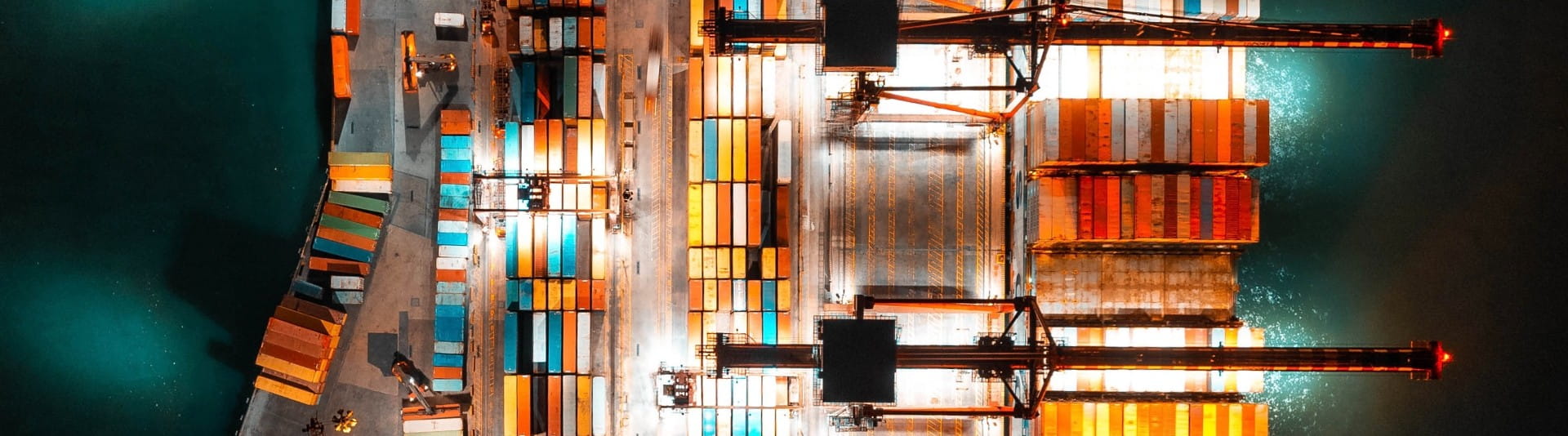

Then, place the inventory in the most heavily utilized areas as well. In the news four or five months ago, we heard about backlogs in the port of L.A for 30, 40, even 50 days before they could get placements to unload. So, how do you de-risk that as much as possible?

Well, you want to be able to access inventory on an as-needed basis. A lot of organizations accrued extra inventory. Now, the benchmark will be how quickly can they shed inventory during the peak season, for example, on e-commerce? Will there be more promotions earlier than we expected because they're trying to deplete inventory as quickly as possible?

Some of the risks are about asking, “What does our current supply chain look like? What ports are we entering? How are we using air freight? Are we using ocean freight? What's our ability to store inventory? How can we get closer to our end customers is a big issue right now from a supply chain perspective, how do you move inventory closer to all of your end customers?” That’s probably one of the things that most companies are starting to think about more carefully and plan strategically around

3. Establish a committee for consistent meetings

Form a committee from the C-Suite to the overall supply chain leadership team with data feeds from marketing and analytics as well because they need to understand where demands originate. What are the SKUs that they need to have ready to sell?

The committee should meet more than monthly to see the kinds of trends by using the data to make informed decisions about where the supply chain executes at the optimum level and how to de-risk that. What’s your Plan B or C and how do you break up the supply chain so you’re not dependent on one holistic means of transportation? If it's ocean freight, do you start to move into air freight a little bit? Do you bring on additional providers to create and lessen the dependencies as well? That's a big issue that a lot of companies are looking at right now—adding more suppliers to their network. I don't think you can be dependent on one carrier relationship any longer. There’s too much risk. You need to have a wide bench of many carriers who can handle different modes of transportation.

Analytics are key to making decisions. We can’t just base it on historical trends because the supply chain is a moving target. It really depends on manufacturing, the ability to move goods from Point A to Point B—that’s critical.

4. Source raw materials

Bring in raw materials to manufacture and source them closer to the end consumer. There’s a huge level of investment that needs to occur there as well, so you have to weigh the pros and cons. Does it make sense to make this significant investment to source all the raw materials in-country versus the cost of manufacturing externally? It's a build-or-buy type of scenario.

Teams should be looking at that for the C strategy. Okay, what’s our doomsday strategy? Here’s where we pivot option one, where we move from one supply chain to another. For example, if all my goods are coming via the ocean, do I start to move some of them via air freight?

Scenario two would be how do I look at where I'm serving my customers? Do I bring it to a different geography so I can move it across different parts of the country a little easier?

Scenario three would be to ask, “How do I look at this from a completely different perspective and rebuild my supply chain from sourcing raw goods in the states, using the states as an example, and just building the products here or manufacturing the products here?” You have to look at it from different lenses.

5. Prepare human capital to support supply chain needs

Discussions we have with clients rely on how to place human capital to support their supply chain needs. Where and how will you need assets? How often? What are the roles and how are they going to change over time?

It’s a great opportunity for staffing agencies to re-skill and upskill people. Traditional supply chain jobs of working in a warehouse and moving products from point A to point B or working on a belt are suddenly going to change and you're becoming much more fluent in technology. Artificial intelligence is dramatically changing the landscape as well.

Workers need to be certified in certain cases to use a certain type of equipment in warehouses to execute their jobs. It's a combination of what companies are thinking about the current employment pool and how they pivot and get those people to be upskilled. Or, reskill them in different jobs that now incorporate some certain level of technology.

Human talent continues to evolve. This conversation may dramatically change in three to six months; it really depends on a lot of external forces. Elections, the war in Ukraine, inflation concerns and technology advancements are concepts that keep us awake at night asking, “How do we play in this space? And how do we continue to position opportunities for people in the organization's supply chain?”